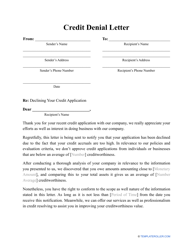

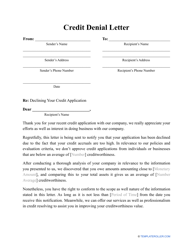

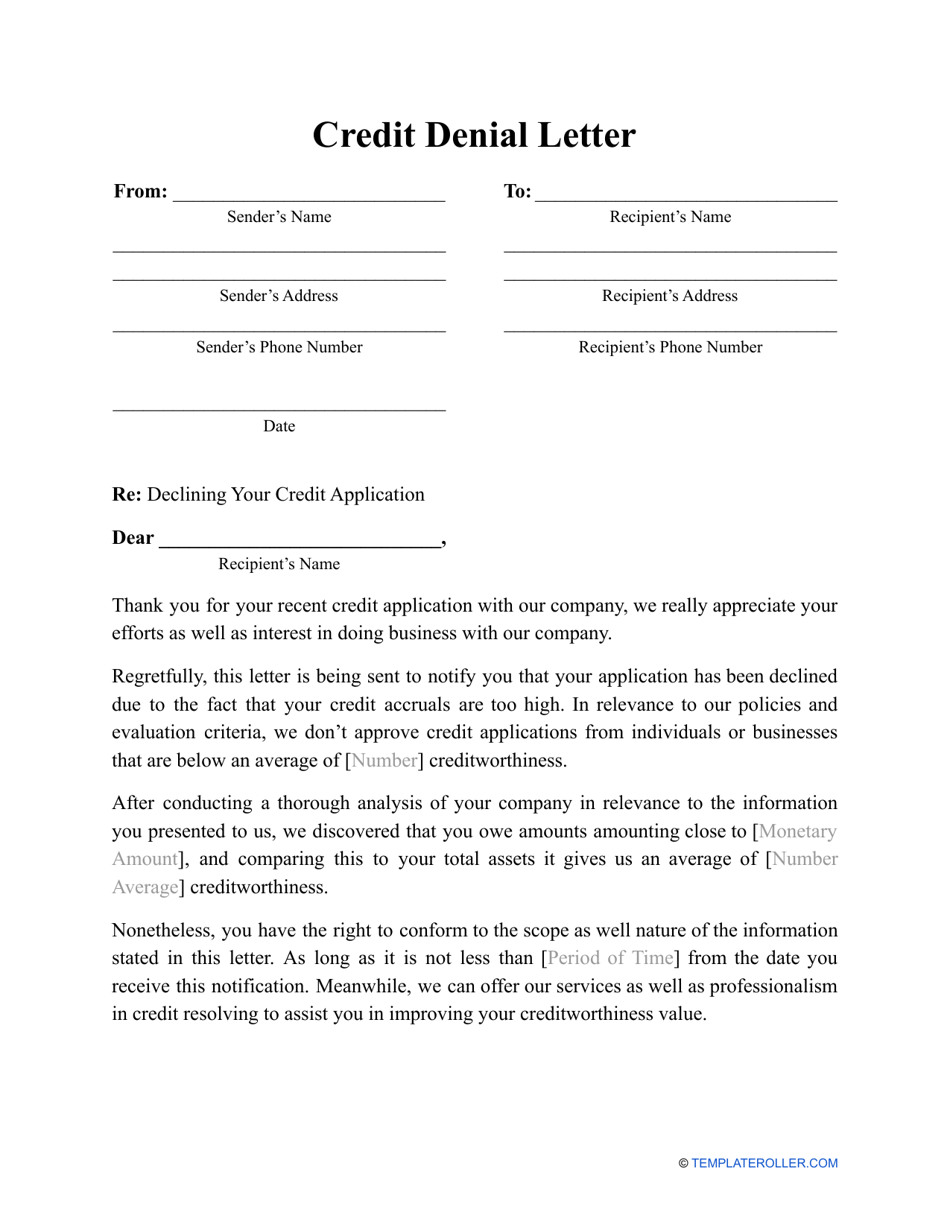

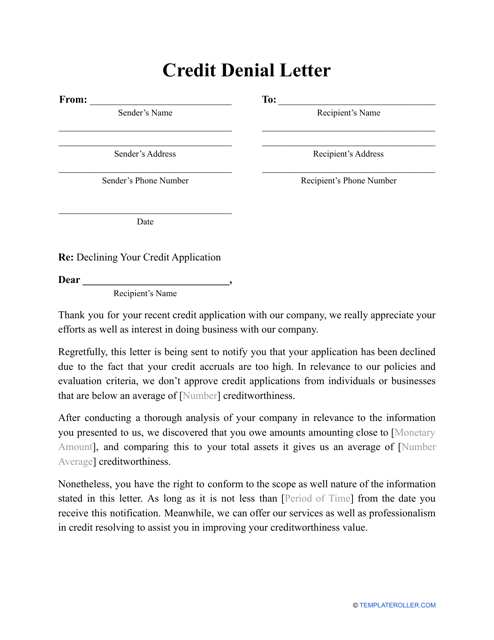

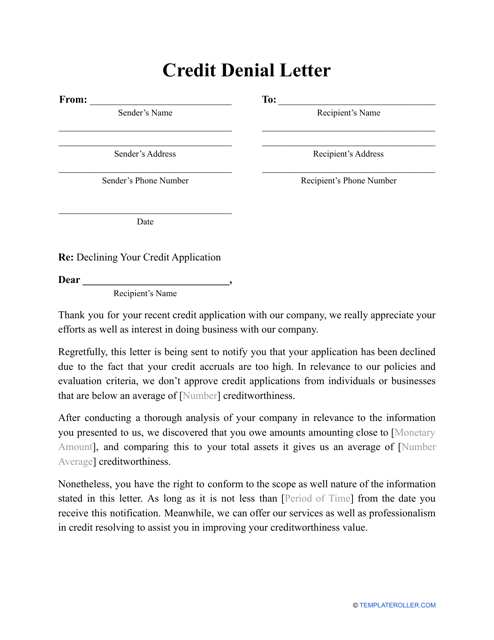

Credit Denial Letter Template

A Credit Denial Letter is a written document prepared by the financial institution (a bank or a building society) that has received a Credit Application from an individual or organization and needs to reject it.

- Credit Application Denial Letter;

- Denial of Credit Letter.

Whether the potential creditor was unhappy with the negative items they discovered in the applicant's credit report, they were not provided with enough information to make an informed decision, or the credit history of the prospective borrower contained unclear details, it is within the creditor's rights to deny the credit yet explain to the person or company that requested it their reasoning. Download a printable Credit Denial Letter template through the link below.

ADVERTISEMENT

How to Write a Credit Denial Letter?

Make sure that your Denial of Credit Letter includes the following parts.

- Introduction. Indicate who you are addressing. Enter the credit applicant's name, full address, telephone number, and email. The address can include their ZIP code, state, city, street name, and building number.

- Information About the Denial. Announce that the Credit Application was denied. Provide information about which application was denied by stating its date and number (if applicable). If you are willing to reconsider the decision you have made, can state that and explain what the credit applicant should do to meet your criteria. For example, you can request additional documents and state the time period during which the credit applicant should submit those documents.

- Reasons for Denial. Use this part of the letter to designate the reason (or list reasons, if there are more than one) why the Credit Application has been denied. It can include reasons such as insufficient credit references, delinquent credit obligations, poor tax records, bankruptcy, incorrect financial details, etc.

- Additional Information. If you conducted a screening of the credit applicant, you can provide information on what agency has made a report. Attach a copy to the letter or offer the applicant to request a copy from them.

- Contact Information. Provide your contact information, in case the credit applicant will have any questions. Provide the name of the person to contact, their email, telephone number, and postal address (if applicable).

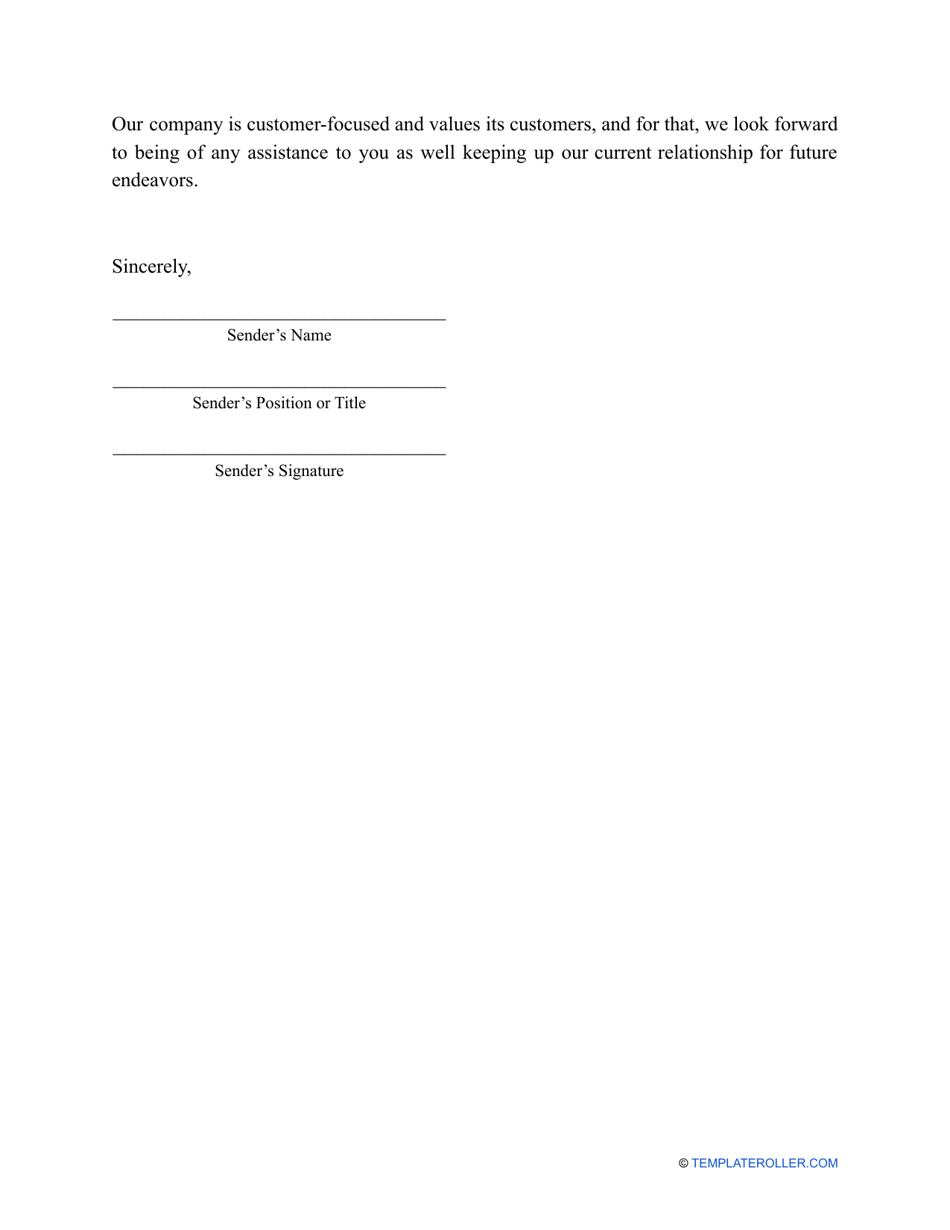

- Conclusion. Thank the credit applicant for addressing you and express appreciation of the applicant's interest. Say that you regret the denial of the application, and hope to work with the credit applicant if they apply for credit again in the future.

A Credit Application Denial Letter can include other parts as well. Its content will depend on the specifics of the situation and on what a prospective lender would consider as valuable information to share.

Haven't found what you were looking for? Take a look at these related templates below:

Download Credit Denial Letter Template

4.5 of 5 ( 14 votes )

1

2

Prev 1 2 Next

ADVERTISEMENT

Linked Topics

Credit Denial Letter Template Rejection Letter Template Denial Letter Template Debt Letter Template Letters

Related Documents

- Sample Credit Denial Letter

- Credit Application Form

- Security Agreement Template

- Claim Denial Letter Template

- Insurance Claim Denial Letter Template

- Credit Dispute Letter Template

- Credit Inquiry Removal Letter Template

- Irrevocable Letter of Credit Template

- Sample Unemployment Denial Appeal Letter

- Sample Appeal Letter for Insurance Claim Denial

- Sample Appeal Letter for Long Term Disability Denial

- Sample Appeal Letter for Medical Claim Denial

- Sample Hardship Letter for Credit Card Debt

- Letter of Credit Template

- Sample Debt Validation Letter to Credit Bureaus

- Credit Card Authorization Letter Template

- Standby Letter of Credit Template

- Credit Card Dispute Letter Template

- Sample Cover Letter for Online Job Application

- Sample Letter of Application for Scholarship

- Convert Word to PDF

- Convert Excel to PDF

- Convert PNG to PDF

- Convert GIF to PDF

- Convert TIFF to PDF

- Convert PowerPoint to PDF

- Convert JPG to PDF

- Convert PDF to JPG

- Convert PDF to PNG

- Convert PDF to GIF

- Convert PDF to TIFF

- Split PDF

- Merge PDF

- Sign PDF

- Compress PDF

- Rearrange PDF Pages

- Make PDF Searchable

- About

- Help

- DMCA

- Privacy Policy

- Terms Of Service

- Contact Us

- All Topics

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

Notice

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.